New school funding plan could mean property tax relief for Sussex County

BY ERIKA NORTON

VERNON — Governor Chris Christie’s new school funding plan for the state of New Jersey could mean significant property tax cuts for Sussex County residents, if the plan passes.

The governor's “Fairness Formula,” introduced on June 21, would give every school district the exact same amount of state aid per student — $6,599 per pupil for each district. According to Christie, the proposed plan would significantly reduce aid to urban districts while lowering property taxes in many suburban towns.

“It is time to change the failed school funding formulas and replace them with one that will force the end of these two crises: the property tax scandal and the disgrace of failed urban education,” Christie said in his speech introducing the plan.

The plan

The state currently gives $9.1 billion directly to school districts using a weighted formula used to determine per-pupil funding for special education students, students from low-income families and those learning English as their second language. Of that $9.1 billion, about $5.1 billion goes to 31 districts deemed “poorer urban districts” or “special needs districts,” while the other $4 billion goes to the remaining 546 districts, according to Christie.Under the new plan, those 31 urban districts that receive more than half of the state’s aid would see a decrease, while 75 percent of school districts would see an increase in state funding. The governor argued that more money for urban schools hasn't worked, citing that 27 out of the 31 urban school districts have graduation rates below the state's overall 90 percent graduation rate.

"That is an unacceptable, immoral waste of the hard-earned money of the people of New Jersey," Christie said.

Property tax relief

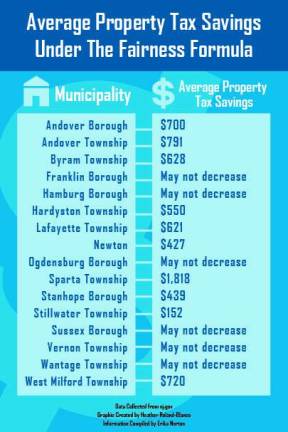

In the state where property taxes are the highest in America — nearly four times higher than the national average according to a report released by WalletHub — increasing state aid would mean property tax cuts for many New Jersey residents. In Sussex County, 16 out of 24, or 67 percent of the municipalities in the county, would see a decrease in property taxes.The greatest decrease in the county would be in Sparta Township, where residents would see an average decrease of $1,818, according to the governor’s website. Sparta Township Mayor Christine Quinn said she is in support of changing the current funding formula.

“It is encouraging to see that the formula is under review,” Quinn said in a statement. “Looking at re-distribution of funding across the student population rather than the student location will ensure that each district and more importantly each student receives their fair share. The impact of legislation such as this offers tremendous opportunity for municipalities such as Sparta.”

Other towns in Sussex County that would see property tax cuts include Andover Borough, Andover Township, Byram, Hardyston, Lafayette, Newton, Stanhope and Stillwater.

However, not all municipalities would see these tax cuts. According to the governor’s website, the Fairness Formula may not result in a decrease of property taxes for towns such as Franklin, Hamburg, Ogdensburg, Sussex, Vernon and Wantage.

While Vernon residents likely won’t see any property tax savings from the plan, Mayor Harry Shortway, who taught for seven years at Jefferson High School, said he thinks it is good that the current school funding formula is being looked at.

“I don’t think most taxpayers know that their tax dollars are being spent in faraway places such as Camden, Paterson and Passaic,” Shortway said. “I’m not saying they don’t need aid, they do. I just think that money isn’t the cure all.”

In Passaic County, West Milford would also see an average property tax decrease of $720. West Milford Township Mayor Bettina Bieri said she has asked for this topic to be discussed at the next Township Council workshop meeting.

“As you can see, according to the Governor's website, this funding formula for schools would bring fairness to school funding because funding for every child would be identical, regardless of location or district,” Bieri said in a statement. “Furthermore, this equalization formula could bring tax relief of $720 annually for the average household in West Milford. Therefore, it is imperative that the governing body take any necessary action to support this Fairness Formula pending further investigation/confirmation of the facts.”

Will the plan pass?

The Fairness Formula plan would be an amendment to the state's constitution, put before voters on the fall 2017 ballot, an election that will also decide the next New Jersey governor. Since its introduction, the plan has gained both support and criticism.Senator Steve Oroho, Senator Parker Space, and Assemblywoman Gail Phoebus (all R-Sussex, Warren, Morris) have all come out in support of the plan.

“Sussex, Warren, and Morris counties have been short-changed by this unequal system for way too long at the benefit of wealthy urban enclaves like Hoboken and Jersey City,” they said in a statement. “We look forward to enacting a fairer school funding formula soon.”

However, the New Jersey Education Association President Wendell Steinhauer does not support the plan, claiming it would “harm the most vulnerable children.”

“Gov. Christie’s proposal would result in a huge step backward to the days when poor families in economically challenged communities were left to fend for themselves,” Steinhauer said in a statement. “By sending equal dollar amounts per pupil to each district, regardless of need, his plan would subsidize those who have the most at the expense of those who have the least. That is the opposite of fair; it’s despicable.”

Christie said he plans to travel across the state this summer to promote his plan.